VIDEOS

Understanding Your Paycheck

This video explains your paycheck line by line.

Entendiendo su Cheque de Pago

Este video explica su cheque de pago línea por línea.

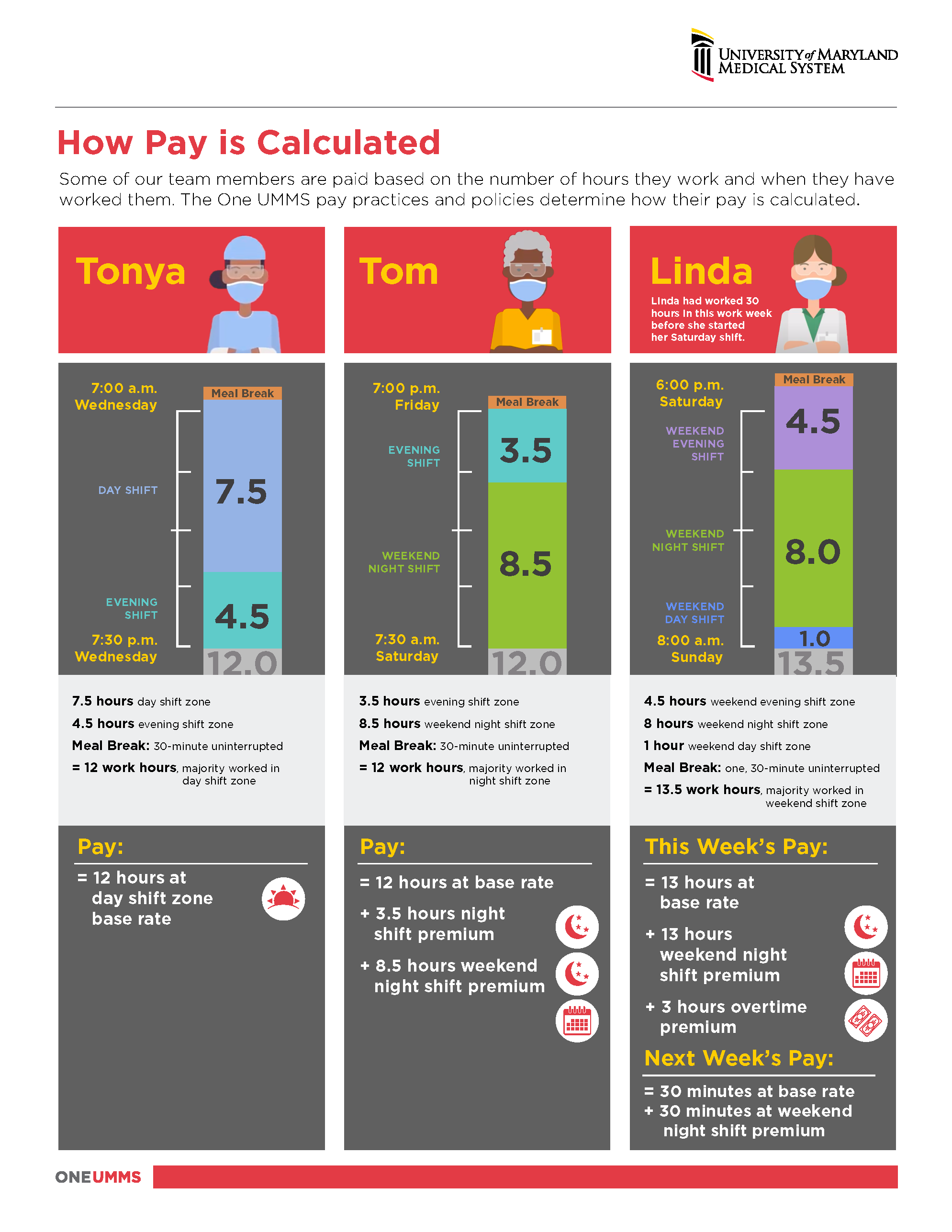

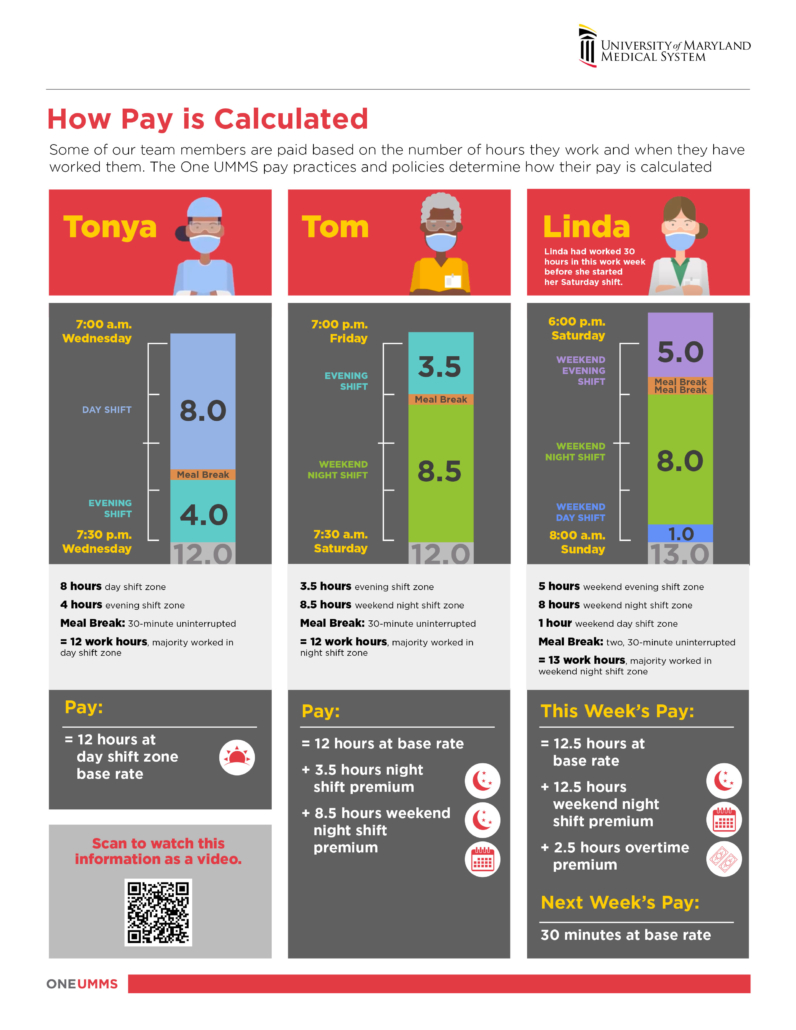

How Pay is Calculated

The One UMMS pay practices and policies change how our pay is calculated.

This video explains the calculations in three simple scenarios.

Cómo se Calcula su Cheque de Pago

Las prácticas y políticas de pago de One UMMS cambian la forma en que se calcula nuestro pago.

Este video explica los cálculos en tres escenarios simples.

INFOGRAPHICS

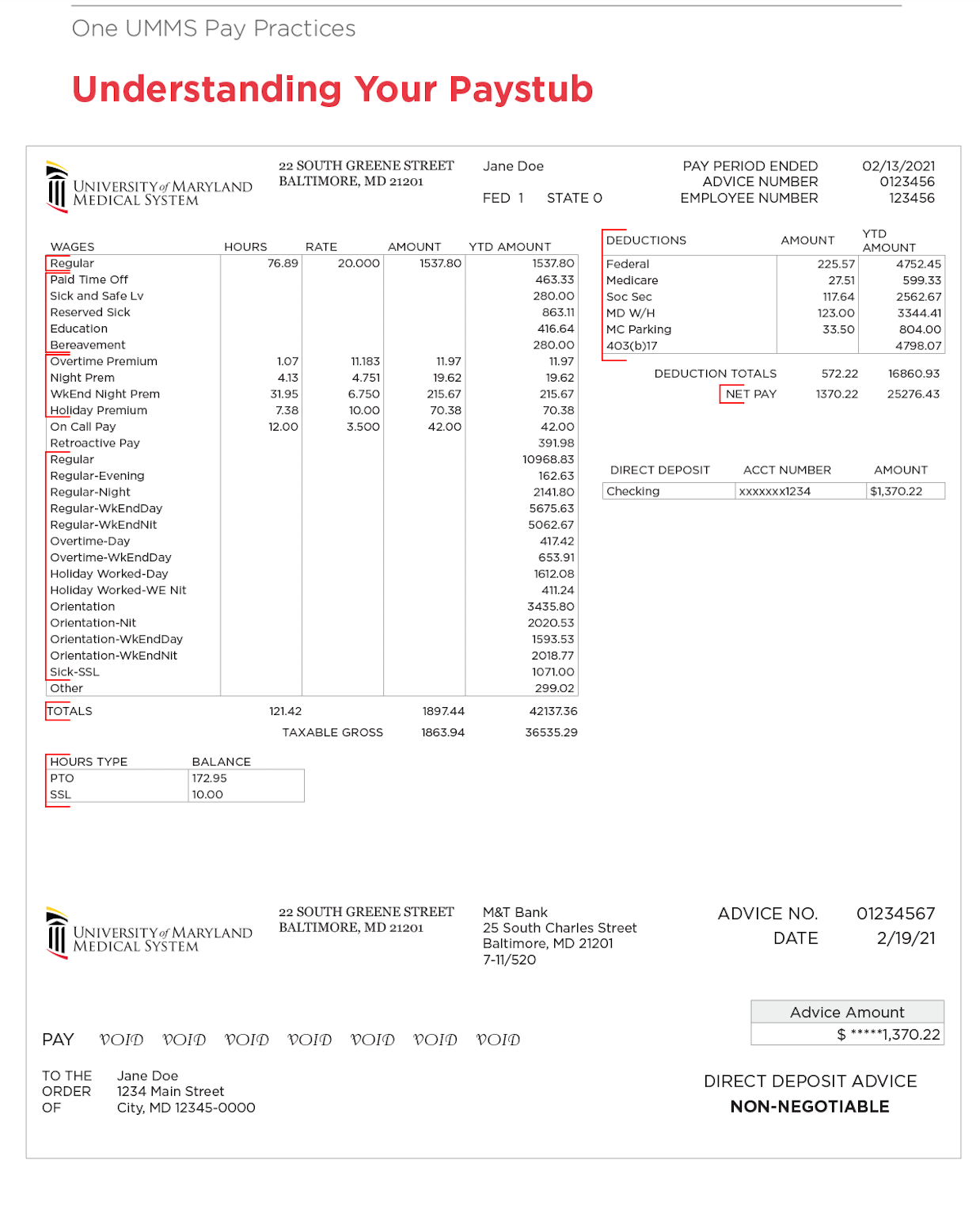

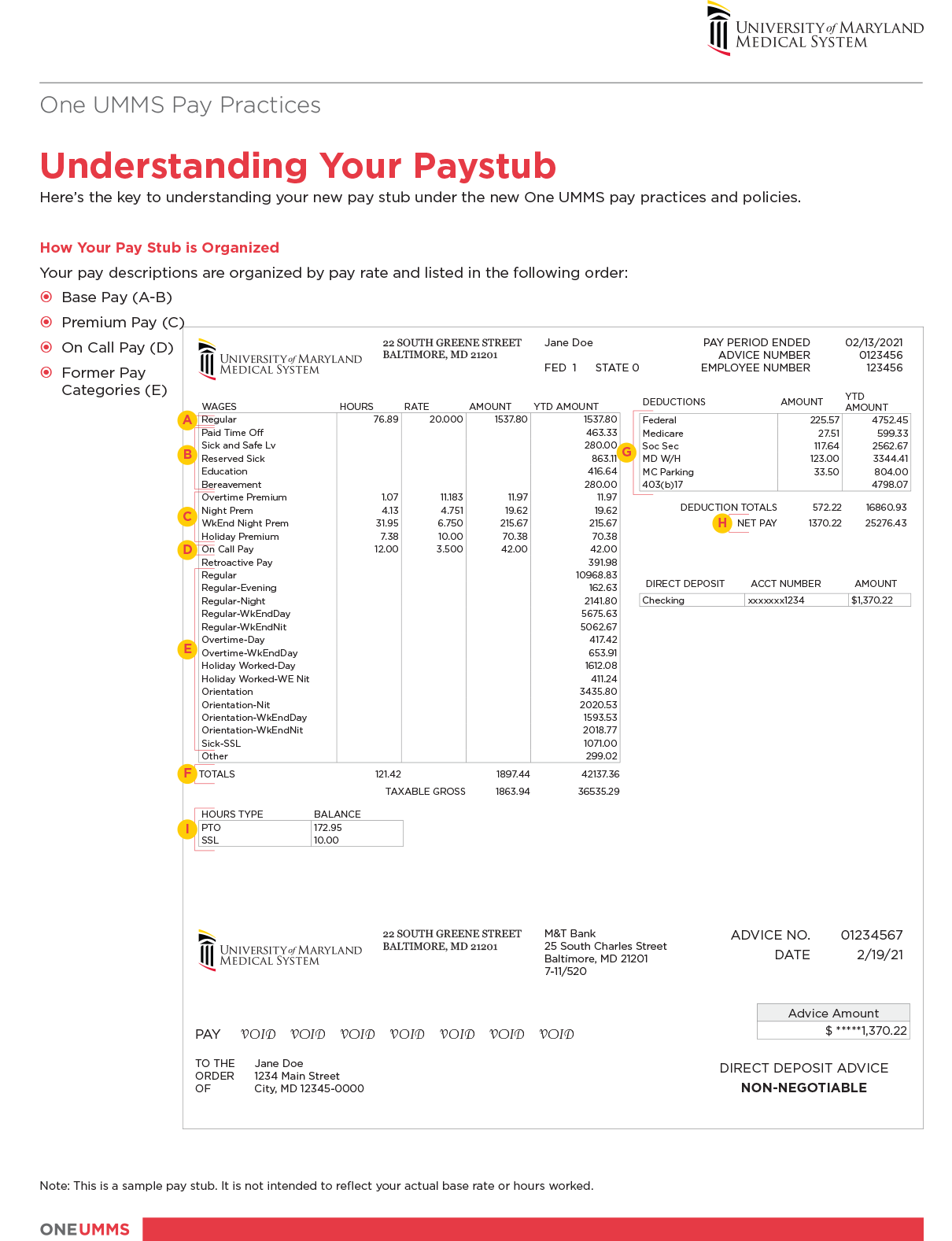

NOTE: Team members at UM Upper Chesapeake Health will find their wellness incentive recorded on their paystub as WellInct under “Wages” on the left side of the paystub.

VIDEOS

Understanding Your Paycheck

This video explains your paycheck line by line.

Entendiendo su Cheque de Pago

Este video explica su cheque de pago línea por línea.

How Pay is Calculated

The One UMMS pay practices and policies change how our pay is calculated.

This video explains the calculations in three simple scenarios.

Cómo se Calcula su Cheque de Pago

Las prácticas y políticas de pago de One UMMS cambian la forma en que se calcula nuestro pago.

Este video explica los cálculos en tres escenarios simples.

INFOGRAPHICS

NOTE: Team members at UM Upper Chesapeake Health will find their wellness incentive recorded on their paystub as WellInct under “Wages” on the left side of the paystub.

FAQs

ONE UMMS PACYHECK FAQS

My paycheck doesn’t look like I thought it would. What could the difference be?

Your new paycheck will look different than what you’re used to. Our payroll team has taken great care to ensure all team members are paid accurately based on the new pay practices. If your pay seems more than or less than you thought it would be, here are a few reasons that may explain why:

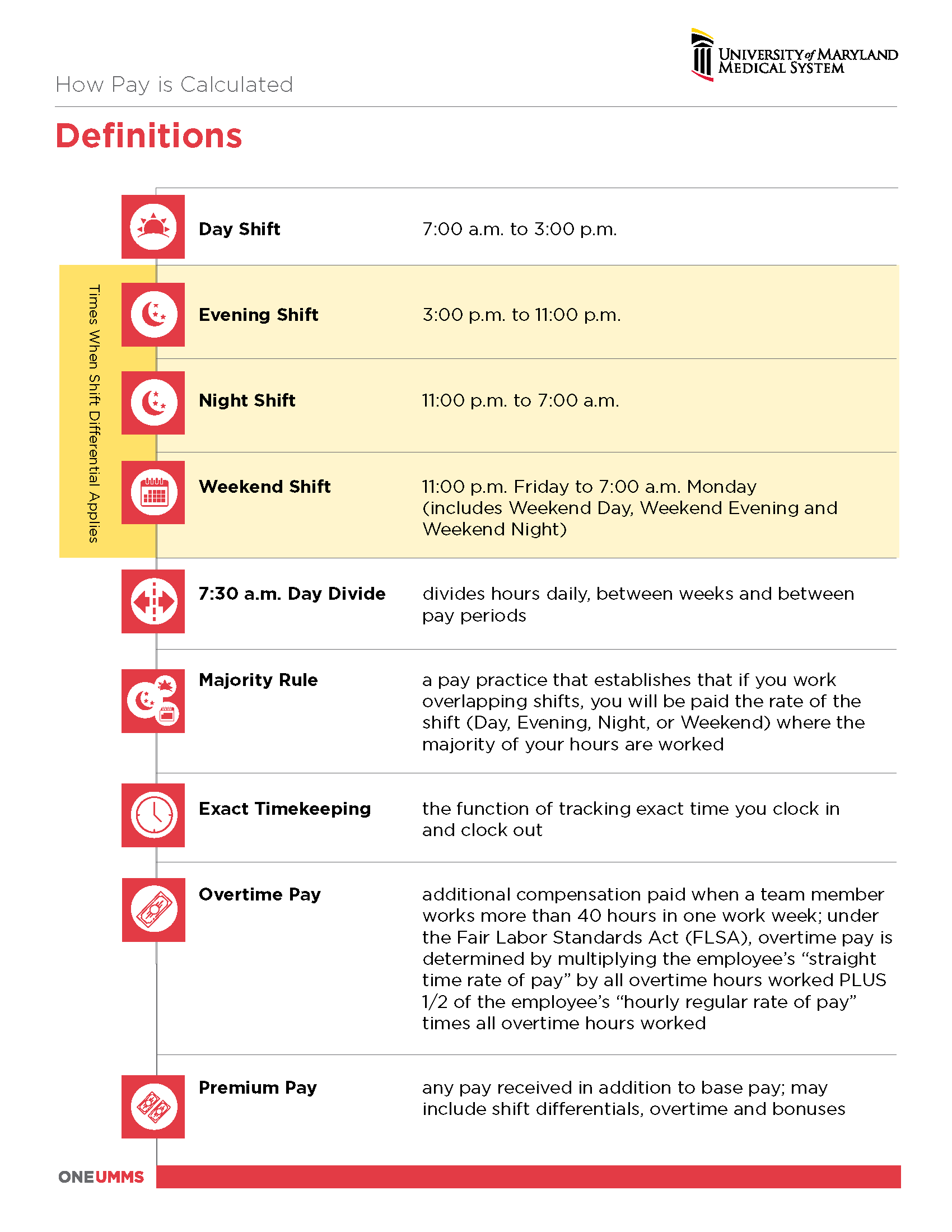

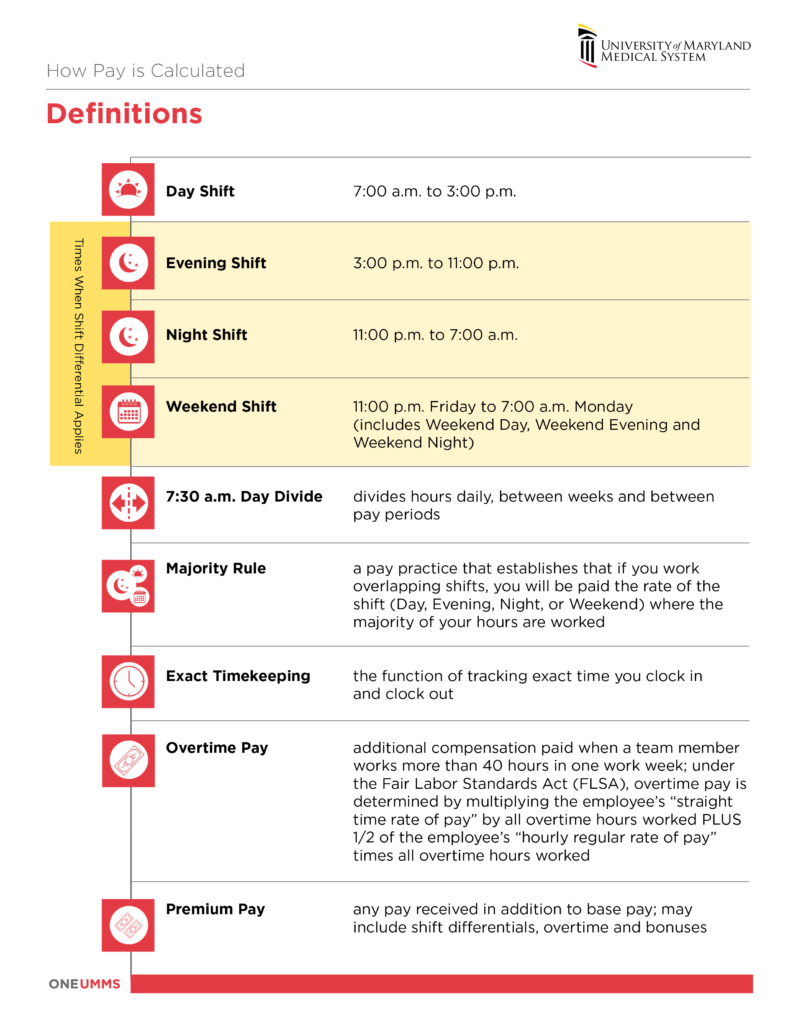

- The new shift differential and/or on call rates have been applied.

- Majority rule was applied, which means that if you worked across more than one shift zone, you were paid the rate of the shift where the majority of your hours were worked.

What do I do if I think there’s something else wrong with my paycheck?

First, talk with your manager and specifically identify your concern. Your manager has access to your individual data and can help explain how the new pay practices have affected your paycheck. If you have further questions, reach out to your HR Business Partner.

Why does the overtime amount line not total 1.5 times my regular rate?

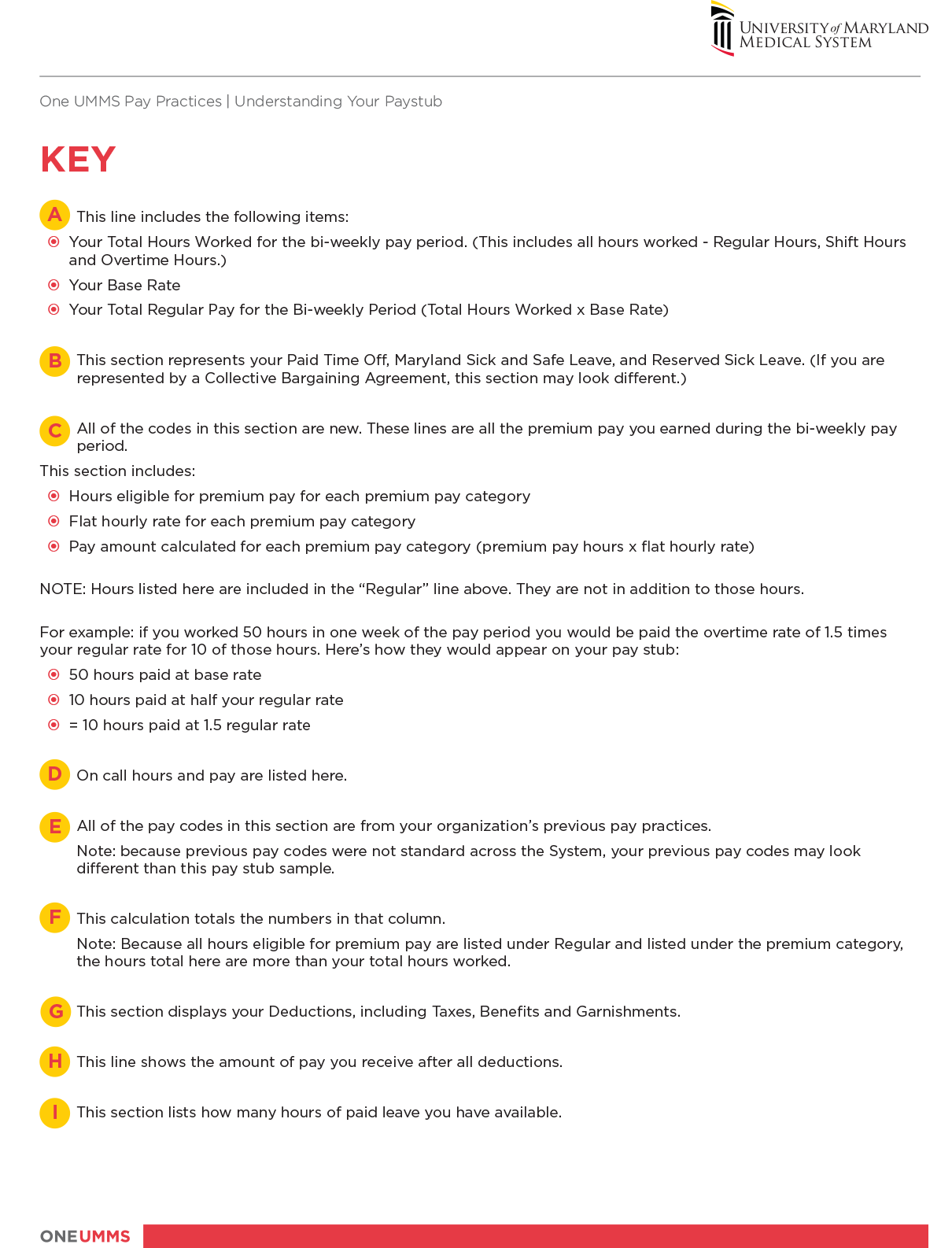

The way we show your overtime compensation has changed but be assured you are being paid for your overtime hours. If you worked 50 hours in one week, all of those hours are shown in the top line where you are paid your base rate. Then, all hours eligible for overtime – in this case, 10 – are shown in the overtime line where you are paid an additional half (.5) of your regular (FLSA) rate for that week.

Why does the totals line show more hours than I actually worked?

The “TOTALS” line calculates all of the numbers in that column. That means that the hours listed here will often be more than the total hours you worked in that pay period. This happens because all hours eligible for premium pay are listed under Regular and listed under the premium category.

How can I tell which premium pay is related to pandemic bonus and which is normal premium pay?

If you have received premium pay associated with a pandemic policy or another bonus program, it will appear in the premium pay section of the paystub with its own pay code.

Where is my vacation or personal time listed?

Our new PTO program includes all paid leave that was previously called vacation, personal, sick and holiday time. On the new paystub, your paid time off is labeled in three categories: Paid Time Off, Sick and Safe Leave, and Reserved Sick Leave (“UMMS Sick” in People Planning). If you are represented by a Collective Bargaining Agreement, your time may be listed differently.

Updated: 5/27/2022

Samuel M. Galvagno, DO

Samuel M. Galvagno, DO